MicroStrategy has bought Bitcoin for 786 million dollars

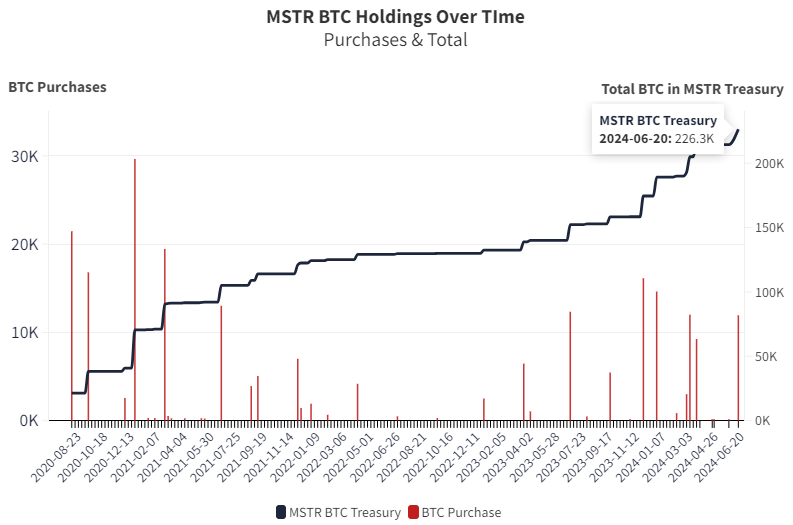

MicroStrategy, the first public company to pursue a Bitcoin strategy, has announced today that it has purchased additional coins - 11,931 BTC for a total of 786 million US dollars. This means that the software company founded by Michael Saylor now holds 226,331 BTC worth almost 15 billion US dollars.

MicroStrategy has acquired an additional 11,931 BTC for ~$786.0M using proceeds from convertible notes & excess cash for ~$65,883 per #bitcoin. As of 6/20/24, $MSTR hodls 226,331 $BTC acquired for ~$8.33B at average price of $36,798 per bitcoin.https://t.co/jE9dGqqnON-

Michael Saylor⚡️ (@saylor) June 20, 2024

MicroStrategy continues to improve

With the latest Bitcoin purchase, MicroStrategy has increased its previous Bitcoin holdings by more than 5 percent. This shows that the company is sticking to its strategy of buying as much of the asset as possible, even at a price of over USD 65,000 per Bitcoin. The 226,331 Bitcoin on the balance sheet of the public limited company correspond to around 1.08 percent of all the almost 21 million Bitcoin that have ever existed.

MicroStrategy put a little less than USD 66,000 per Bitcoin on the table for the 11,931 BTC. This increased the average purchase price for the total holdings from USD 35,180 to USD 36,798 per Bitcoin.

The US software company raised the funds for the purchase by issuing new convertible bonds, which were announced for June 17. MicroStrategy initially wanted to issue convertible bonds with a value of 500 million US dollars. One day later, the company increased the amount to 700 million US dollars and granted lenders the right to purchase convertible bonds for an additional 100 million US dollars within a 13-day period starting from the issue date - Blocktrainer.de reported.

Net of discounts, commissions and issuance costs, MicroStrategy expected to raise exactly $786 million of new capital through the convertible notes, assuming the initial purchasers exercise their option to purchase additional notes in full. Since the company announced the purchase of Bitcoin for exactly this amount just three days after the issue, this suggests that the lenders literally snatched the securities out of the company's hands.

The offering [...] was well received in the market and was increased to an aggregate principal amount of $800.0 million. This amount included the exercise of the initial purchasers' option to purchase an additional $100.0 million of notes. The net proceeds from the offering for MicroStrategy totaled $786.0 million.

From the current SEC filing

The principle of convertible bonds is that creditors lend money to a company and at maturity receive either a predefined number of shares or the loan amount including interest, which is usually below the prevailing market interest rate. In the case of MicroStrategy's latest convertible bonds, the interest rate is 2.25 percent, the expiration date is June 15, 2032 and the lenders can exchange their $1,000 bond for 0.4894 MicroStrategy shares at maturity.

One share is currently trading at around 1,500 US dollars. Accordingly, the lenders are primarily speculating that the share price will be significantly higher in eight years' time so that the purchase of the convertible bonds can become a lucrative business. The risk here is limited, as - provided the company is still solvent by then - the lenders can only demand repayment of the loan amount including interest at the expiry date.

The financing method is attractive for the software company in that it can raise funds without having to sell Bitcoin one day in order to pay off the lenders - provided that the share continues on its successful course. This allows MicroStrategy to buy more and more Bitcoin by diluting the company's shares. So far, the strategy has worked for both MicroStrategy and the buyers of the convertible bonds. The share price has increased more than tenfold since the start of the Bitcoin strategy in August 2020 and the company is currently sitting on more than six billion US dollars in price gains from the Bitcoin purchases.

On June 13, MicroStrategy announced the early redemption of USD 650 million worth of convertible notes. Those who held the convertible bonds were entitled to 2.5125 MicroStrategy shares for every $1,000 bond, almost quadrupling the original amount at the current share price.

The strategy works

MicroStrategy impressively demonstrates how a company can profit from Bitcoin. The strategy is already increasingly being imitated. Meanwhile, Semler Scientific, a healthcare company listed on the Nasdaq, is also taking advantage of the fundraising opportunities on the capital markets to expand its Bitcoin holdings.

Meanwhile, the future for Bitcoin remains promising. The asset has arrived in the midst of the election campaign for the next US president and even the first US state pension fund has bought Bitcoin spot ETFs.

If Bitcoin's success story continues, companies that bet on Bitcoin should also benefit in the long term, provided they are positioned to withstand the sharp corrections that are typical of Bitcoin.

It remains to be seen when, to what extent and via which financing method MicroStrategy will follow suit next time and whether other companies will follow suit.