Asset manager BlackRock published a new report yesterday, September 17, 2024, in which the authors examine the characteristics and benefits of Bitcoin.

The result: Bitcoin is fundamentally different from other assets and could increasingly establish itself as protection against currency devaluation, escalating sovereign debt and geopolitical uncertainties. The analysts also provide an answer to the frequently asked question of whether Bitcoin is a risk asset or not.

Bitcoin: A Unique Diversifier

In the report entitled "Bitcoin: A Unique Diversifier", the high-ranking BlackRock employees explore why the asset should be extremely attractive for investors. The authors are Robert Mitchnick, Head of Digital Assets, Samara Cohen, CIO of the ETF division and Russell Brownback, Head of Macroeconomic Positioning in the Fixed Income division.

As has become customary for BlackRock, the analysts recognize in the new report the many positive attributes of Bitcoin that make it an asset that investors can - and increasingly are - using to better position their portfolios.

Bitcoin’s nature as a scarce, non-sovereign, decentralized global asset has caused some investors to consider it as a flight to safety option in times of fear and around certain geopolitically disruptive events.

from the report

Ever since the world's largest asset manager launched its own Bitcoin spot ETF, the number of positive voices from BlackRocks about Satoshi Nakamoto's creation has been increasing. A few weeks ago, CEO Larry Fink emphasized that he considers Bitcoin to be a legitimate asset that could provide protection against the escalating national debt and the associated currency devaluation - Blocktrainer.de reported.

Why Bitcoin is important

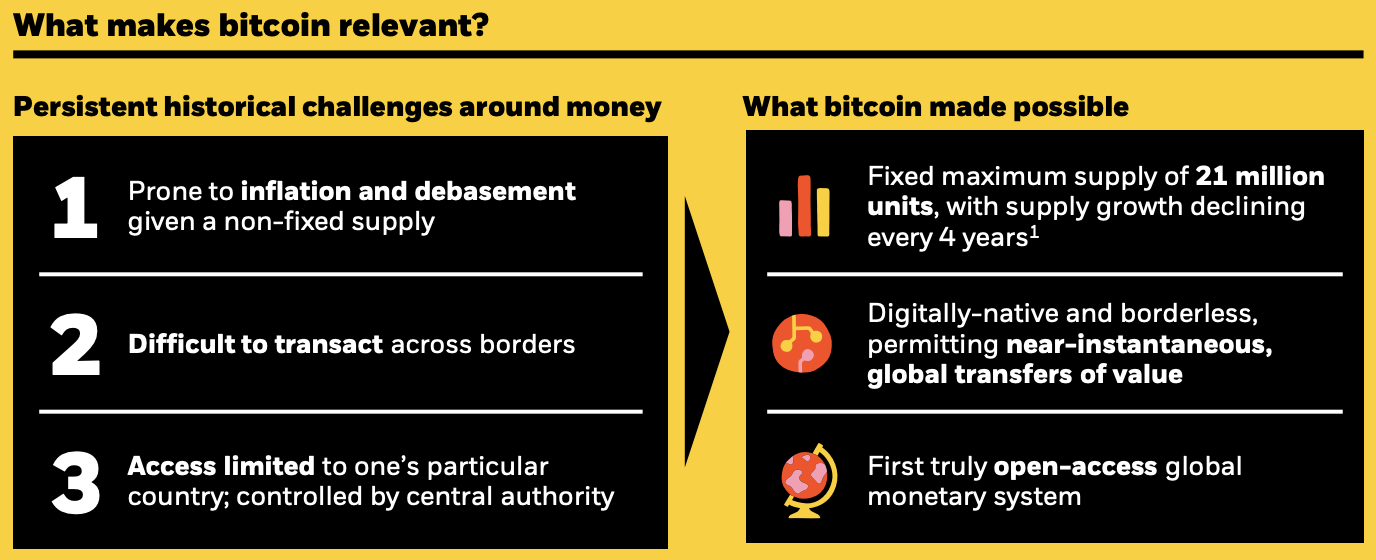

At the beginning of the report, the authors discuss the extent to which the characteristics of Bitcoin potentially make the asset a relevant financial instrument.

Its technological innovation was the creation of a form of currency that was digitally native, global, scarce, decentralized and permissionless.

from the report

They highlight three attributes that may provide answers to current problems of the current prevailing monetary system: fixed total quantity, unique transportability and free access to the network.

These are to be understood as a possible solution to the devaluation of money or inflation, the hurdles to transactions and the lack of financial inclusion in the current financial system, as the infographic from the BlackRock report illustrates.

In this context, the authors also point out that Bitcoin clearly stands out from the countless alternative cryptocurrencies and holds a "unique position".

While other cryptoassets have since been built on the back of bitcoin’s original breakthrough, in many cases in pursuit of a wider breadth of use cases, there has been a global coalescence around bitcoin as the preeminent asset in the space.4 This has given it a position, uniquely amongst the cryptoasset universe, as a global monetary alternative and an asset with credible scarcity.

from the report

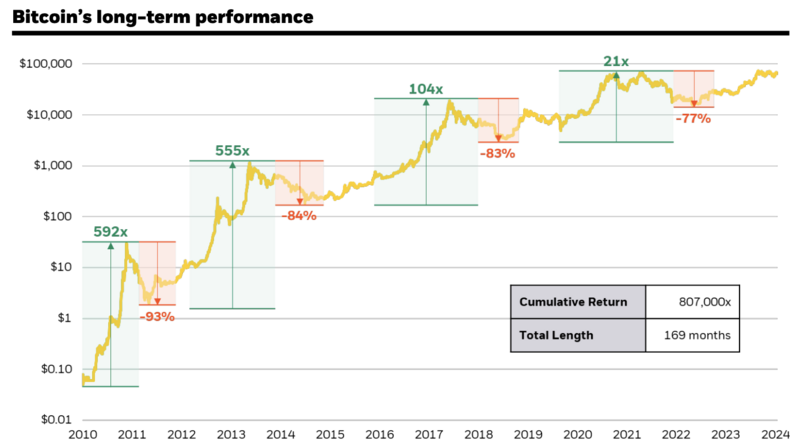

Unbeatable performance

The phenomenal returns that have been generated with a Bitcoin investment over the past few years are also taken into account in the report.

Over the past 14 years or so, the price of Bitcoin has increased more than 800,000-fold, making the asset look old-fashioned compared to all other asset classes.

Bitcoin outperformed all major asset classes in 7 out of the last 10 years, leading it to an extraordinary return in excess of 100% annualized over the last decade. This performance was achieved despite bitcoin also being the worst performing asset in the other three of those 10 years, with four drawdowns in excess of 50%.5,6 Through these historical cycles, it has shown an ability to recover from such drawdowns and reach new highs, despite these extended bear market periods.

from the report

In this context, the authors conclude that these price fluctuations "reflect, in part, its evolving prospects through time" for "widespread basis as a global money alternative".

Low correlation with the equity markets

In order to find out whether and why Bitcoin is a suitable asset to better position a portfolio, the BlackRock employees look at the correlation to the US stock market in the report.

They found that Bitcoin - like the precious metal gold - has a very low correlation with the US stock index S&P 500 over a long-term period. Gold has an average value of 0.1 and BTC a slightly higher value of 0.2.

The correlation of asset classes can be depicted in a range of numbers from -1 to 1. With a correlation of 1, the assets under consideration move in lockstep and with a value of -1 in the completely opposite direction. If the value is 0, there is complete independence in the price movement.

Mitchnick and co. explain that despite short-term periods in which Bitcoin has moved hand in hand with the stock market, in the long term it is independent of the variables that affect traditional assets.

Bitcoin reflects little fundamental exposure to other macro variables, explaining its low long-term average correlation with equities and other “risk assets.” While there have been brief periods where bitcoin has seen its correlation spike – particularly around episodes of sudden shifts in U.S. dollar real interest rates or liquidity – these episodes have been short-term in nature and have failed to produce a clear long-term statistically significant correlation relationship.

from the report

The authors explain this observation by the fact that Bitcoin has no counterparty risk and therefore certain crisis situations do not pose a fundamental threat to Bitcoin.

Bitcoin, as the first decentralized, non-sovereign monetary alternative to gain widespread global adoption, has no traditional counterparty risk, depends on no centralized system, and is not driven by any one country’s fortunes.7 These properties make it an asset that is largely detached (on fundamentals) from certain critical macro risk factors, including banking system crises, sovereign debt crises, currency debasement, geopolitical disruption, and other country-specific political and economic risks.

from the report

Nevertheless, the state of the financial system, as well as the US sovereign debt problem, could be or become a driver for the Bitcoin price, the BlackRock employees recognize.

Over the long term, bitcoin’s adoption trajectory is likely to be driven by the intensity of concerns over global monetary stability, geopolitical stability, U.S. fiscal sustainability, and U.S. political stability. This is the inverse of the relationship that is generally attributed to traditional “risk assets” with respect to such forces.

from the report

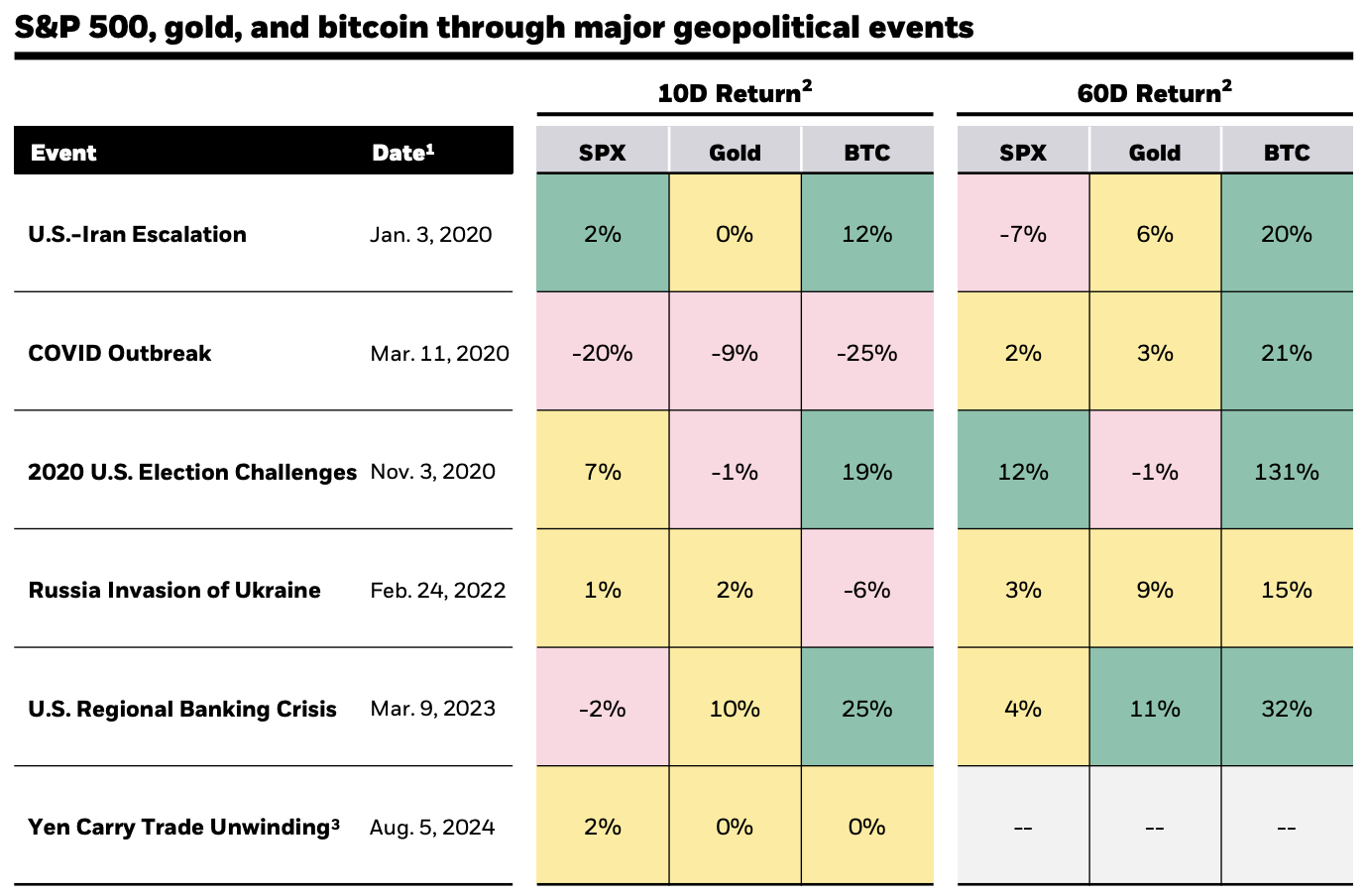

Flight to safety

Due to Bitcoin's characteristics, some investors see the asset as a hedge in times of crisis, according to the authors of the report. In the context of the escalating conflict in the Middle East in October last year, BlackRock CEO Larry Fink even attributed the positive price development of Bitcoin in the following days to a "flight to quality" - Blocktrainer.de reported.

BlackRock employees are also investigating how the price has behaved in other such exceptional situations - and they are coming to positive conclusions for Bitcoin.

Specifically, they found that BTC often reacted negatively in the first instance to world-shaking events such as the outbreak of the coronavirus pandemic or the regional banking crisis in spring 2023, but then recovered all the more quickly.

The authors also observed this pattern during the small overall market crash at the beginning of August, when Bitcoin was able to fully recover its losses within a very short space of time.

Mitchnick and co. explain price movements of this kind partly by the fact that Bitcoin is very liquid and can be traded around the clock and that there is still a lack of understanding as to exactly what kind of asset BTC should be classified as.

In this context, high-ranking BlackRock employees even speculate that the narrative is increasingly spreading that Satoshi Nakamoto's creation should actually benefit from such crisis situations and that this is why the price has usually benefited in the medium term after general uncertainty has spread.

In most instances, including with the recent global market sell-off of Aug. 5, 2024, bitcoin has recovered back to its prior level within days or weeks, and in many cases has rallied further as a recognition of the positive potential impact of such disruptive events on bitcoin’s fundamentals begins to predominate.

from the report

Still a risky asset?

Despite the consistently positive observations, the authors do not want to negate the statement that Bitcoin is still risky.

None of the prior analysis negates the fact that bitcoin, on a standalone basis, is still very much a risky asset. It is an emerging technology that is still early in its adoption journey toward potentially becoming a global payment asset and store of value.

from the report

In this context, they also cite the still strong fluctuations in the Bitcoin price and the regulatory challenges.

Strong arguments for Bitcoin

The new report from BlackRock clearly shows the benefits that Bitcoin can offer as a financial innovation and investment object. From an investment perspective, the authors particularly emphasize the low correlation with the stock market and the potential protection against global crisis situations - as the report concludes.

As the global investment community grapples with rising geopolitical tensions, concerns over the state of U.S. debt and deficits, and increased political instability around the world, bitcoin may be seen as an increasingly unique diversifier against some of these fiscal, monetary and geopolitical risk factors investors may face elsewhere in their portfolios.

from the report

Probably the most decisive selling point for Bitcoin is the hedge against the escalating US national debt and the associated loss of confidence in the US dollar. Mitchnick and Co. already explain a large part of the rapidly increasing adoption of the asset. In doing so, they also refer to experience gained from exchanges with their own customers.

Along this vein, the growing concerns in the U.S. and abroad over the state of U.S. federal deficits and debt has increased the appeal of potential alternative reserve assets as a potential hedge against possible future events affecting the U.S. dollar. This dynamic appears to be also taking hold in other countries where debt accumulation has been significant. In our experience with clients to date, this explains a substantial portion of the recent broadening institutional interest in bitcoin.

from the report

Another exciting conclusion is that Bitcoin is also unique in terms of risk and that the classification of "risk-on" or "risk-of-asset" is not really applicable to the asset. As the authors impressively demonstrate, the price of Bitcoin is generally not influenced by the same factors as conventional risk assets - rather the opposite, as Bitcoin seems to benefit more from crisis situations.

Basically, the high-ranking BlackRock employees conclude that a Bitcoin allocation can make sense in order to diversify the investment portfolio - however, a larger allocation can significantly increase the overall risk of the portfolio.