Storing energy with Bitcoin mining

New study on the energy transition

A new, independent study in the "International Journal of Electrical Power and Energy Systems" deals with the integration of mining systems for Bitcoin and other cryptocurrencies in energy storage systems of locally defined power grids, so-called microgrids. The authors of the study work at various universities in Iran, Finland and Canada. In the study, they highlight the great potential of mining in supporting the energy transition and describe the crypto-mining facilities themselves as virtual energy storage systems in which the surplus of renewable energy sources can be stored.

Background to the study

In order to drive forward the energy transition and counteract climate change, measures are being taken worldwide to switch from fossil fuels to low-carbon energy systems. The integration of renewable energy sources, such as solar and wind energy, plays an important role in this. However, the intermittent nature of these renewable energies also leads to challenges, such as dealing with overproduction and bottlenecks as well as balancing supply and demand in the electricity grid (power fluctuations; instability) and the associated rising costs.

Energy storage systems

In a local electricity grid consisting of renewable energy generation plants and energy storage systems, the surplus energy generated during periods of low demand can be used or stored by flexible energy systems. These include, for example, flexible consumers such as heating, ventilation and air conditioning systems that adapt to demand and/or batteries in which the energy is stored. Most conventional energy storage systems are optimized for short-term use and their storage capacity is limited. However, due to the price of energy storage, it is sometimes even cheaper to leave the energy unused and waste it.

Bitcoin mining systems as energy storage

At the same time, renewable energies are increasingly becoming part of mining facilities for cryptocurrencies due to environmental regulations and profitability. The Bitcoin mining industry has become the most sustainable global industry in recent years - Blocktrainer.de reported. There are also numerous practical examples that demonstrate the social and environmental benefits of Bitcoin mining's mobile and modular data centers. Examples include the reduction of CO₂ and methane emissions (e.g. at landfills), which is important for combating climate change, the promotion of infrastructure for renewable energy sources, various concepts for waste heat recovery, access to electricity or the stabilization of electricity grids and prices through the ability to ramp up or down quickly (demand response programs). Many concepts are based on the conversion of unused energy into a monetary value that ultimately reduces operating costs or is invested, for example in the expansion of infrastructure. There are also a few scientific studies on these aspects(electricity grid, emissions).

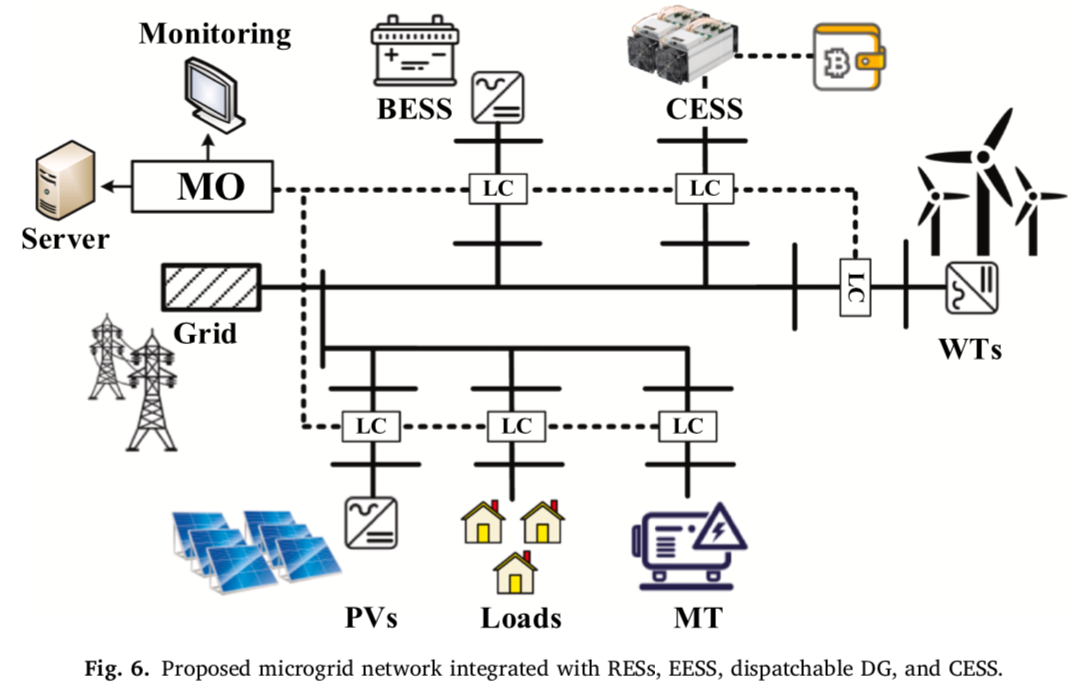

The new study entitled “Cryptocurrency mining as a novel virtual energy storage system in islanded and grid-connected microgrids” is the first to look at the storage of surplus electrical energy in cryptocurrencies such as Bitcoin. The mobile and modular data centers of Bitcoin mining are suitable as flexible consumers that convert excess electrical energy free of charge for the microgrid operator and "store it as money". The money is validated by the consensus mechanism of the proof-of-work and can be exchanged for traditional money and then used to buy electrical energy on the wholesale market and not to expand the infrastructure as in other practical examples. Energy storage and conversion therefore takes place indirectly, because of course no energy can be stored directly in Bitcoin or recovered from Bitcoin. The Bitcoin systems are therefore not only seen as energy consumers with flexible and fast-response properties, but also as a virtual energy storage system that stores surplus energy in the cryptocurrency, which can be used to buy back different amounts of energy on the electricity market as required.

The study describes this new model and the corresponding calculation models for efficient integration into the electricity grid. In doing so, the authors close a gap in the scientific literature.

Advantages of Bitcoin mining

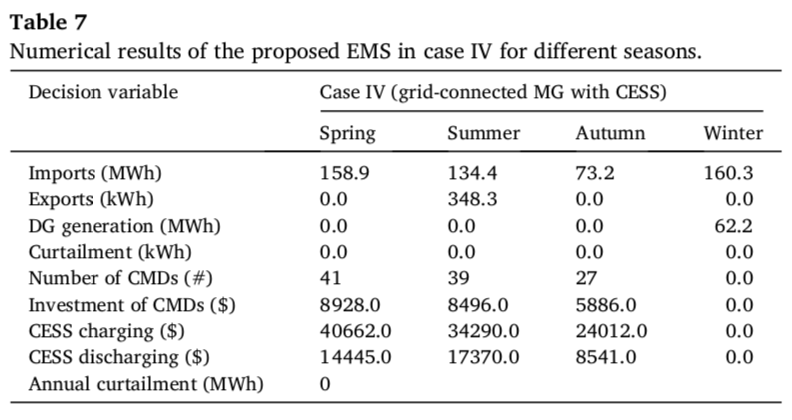

Using a case study with reference data of energy generation, distribution and storage on a Finnish island in the period from the beginning of 2020 to the end of 2022, comparisons are made and the advantages of Bitcoin mining are highlighted. Considering the dynamic nature of microgrids with renewable energy sources and the possible real-time adjustment in response to grid conditions and demand fluctuations, the study describes certain calculation models for different renewable energy source power plants, which can then be used for the cost-based optimization of bitcoin mining plants and their energy management and control systems to get the maximum benefit from the plants.

The case study refers to a microgrid consisting of 50 households supplied by both renewable energy sources and the main grid. The focus is on island operation as well as grid-connected operation of the local power grid both with and without the use of Bitcoin mining for energy storage.

Reduction of costs and energy losses

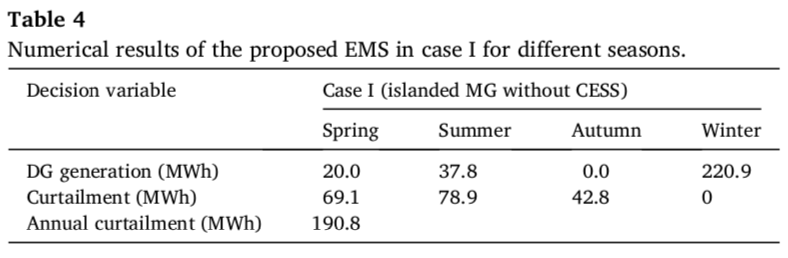

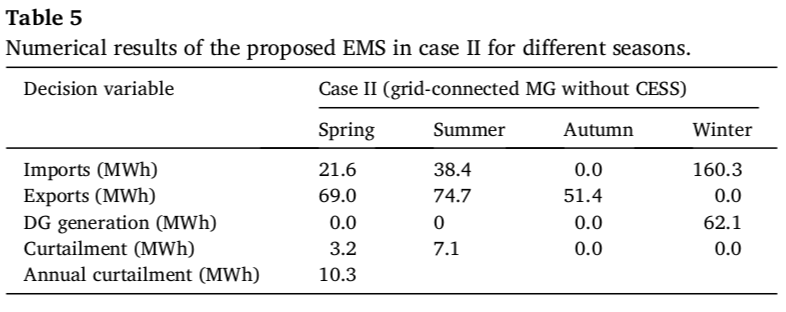

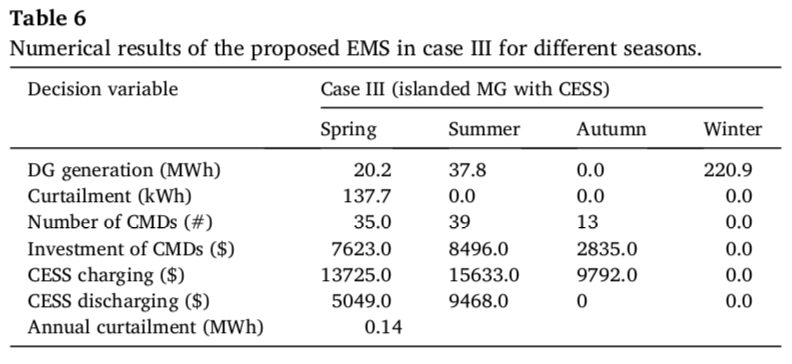

The results of the case study show that Bitcoin mining leads above all to a significant reduction in unused energy and operating costs. While the unused, wasted energy in pure island operation corresponds to a value of almost 191 megawatt hours (MWh), this figure is reduced to a fraction (0.14 MWh) by "storing" the energy in Bitcoin. The situation is similar for grid-connected operation, where surplus energy is sold to the main grid when there is demand (for a third of the purchase price). Without Bitcoin mining, 10.3 MWh would remain unused. The use of the virtual "Bitcoin mining storage", on the other hand, shows that it is more economical to "store" the excess energy in Bitcoin than to sell it, which increases the storage capacity and reduces the unused and thus lost energy to zero MWh.

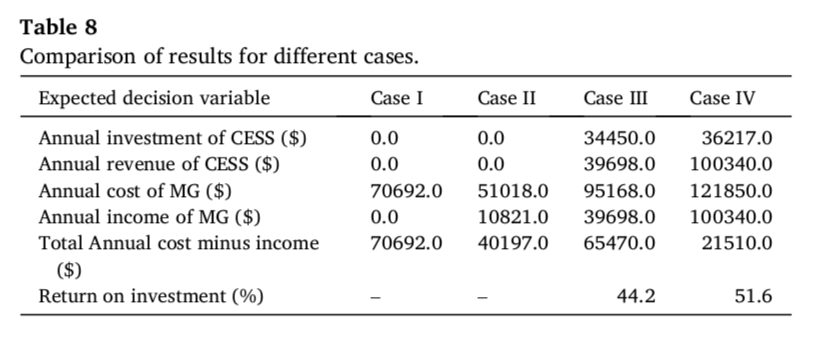

The operating costs and the correspondingly shorter amortization period for the electricity grid operators' investments are similar. Stand-alone operation with Bitcoin mining as a storage system for surplus energy saves 7.4 percent of costs compared to pure stand-alone operation, with a return on investment (ROI) of 44.2 percent. In grid-connected operation, Bitcoin mining even saves 46.5 percent of the costs and the ROI is 51.6 percent.

Comparison with conventional energy storage systems

While surplus energy is often a challenge for conventional energy storage systems because these systems are usually optimized to cover short-term energy requirements and their storage capacity is limited, virtual energy storage systems based on Bitcoin mining can store energy over longer periods of time and thus cover long-term energy requirements. This also offers economic advantages.

The overall costs of the power grid are reduced if the energy storage system with Bitcoin mining stores the renewable surplus energy in Bitcoin during highly productive periods, such as in summer and fall, and releases it later in the form of purchased energy. In this way, the model covers long-term energy requirements and optimizes the use of renewable energy.

The ability of the [energy storage system with Bitcoin mining] to enable monthly/seasonal generation and consumption shifts or monthly/seasonal peak shaving not only results in economic savings, but is also in line with the broader goals of sustainable energy practices and promotes a more resilient and adaptable energy infrastructure. This innovative approach to energy storage and management has the potential to reshape the dynamics of microgrid operations and pave the way for more efficient and environmentally conscious energy use across the board.

Excerpt from the study

Discharge time

One section of the study is specifically dedicated to the technical comparison of the virtual energy storage system of Bitcoin mining with conventional electrical energy storage systems, which can be divided into different groups. This involves technical aspects such as power range, discharge time, energy output, power and energy density, response time, service life and life cycle, operating temperature, nominal voltage, investment costs, self-discharge and overall efficiency.

It is clear that Bitcoin mining has many advantages compared to conventional energy storage systems. One key difference, as already mentioned, is the particular way in which the free surplus energy that would otherwise be wasted is stored in a monetary value that can later be used to purchase electricity.

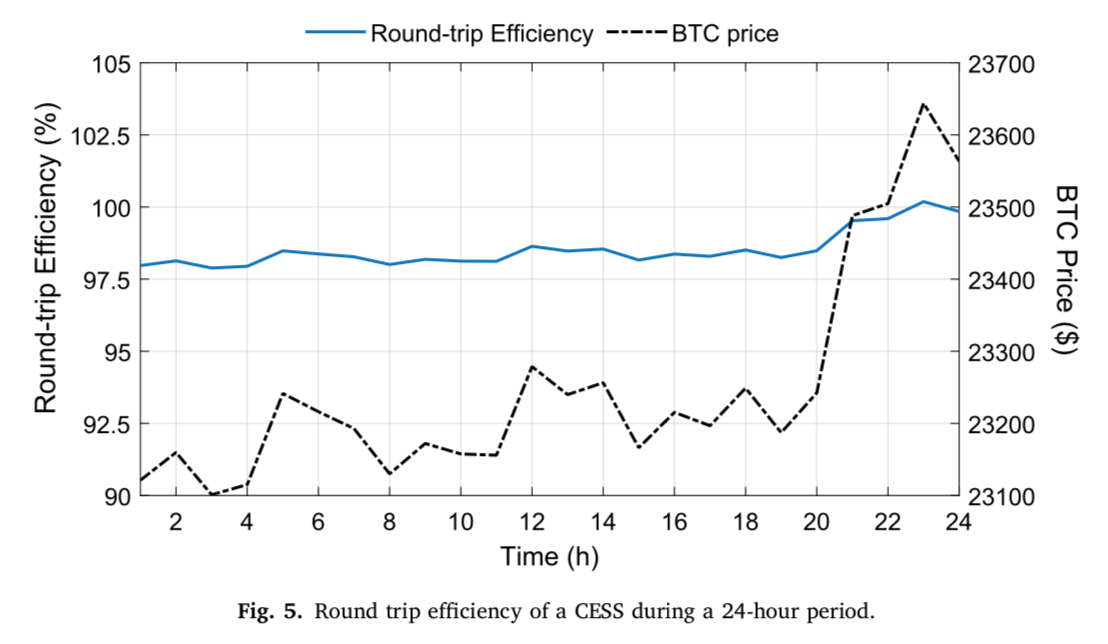

This has an impact on many technical aspects, such as the discharge time of the virtual energy storage system. The discharge time depends on the price of the mined cryptocurrency, the current price of electricity and the amount of money saved from mining, for which there is no upper limit in fiat currency. An increase in the cryptocurrency price increases the amount of energy that can be purchased from the grid. Conversely, a falling price also reduces the amount of energy.

Infinite storage capacity and life cycles

By storing the free surplus energy in a monetary value on a wallet, the energy output or energy storage capacity is unlimited. In relation to their weight, "Bitcoin energy storage devices" can store an infinite amount of energy and supply more energy than conventional storage devices.

In addition, the wallet can be "charged" and "discharged" simultaneously and the life cycle is endless, whereas conventional energy storage systems lose power with each charging and discharging cycle. However, the service life of the mechanical components in conventional systems can be significantly longer than in ASIC miners, which have an expected service life of 2.5 to 5 years.

However, conventional systems cannot maintain the stored energy at a constant level due to self-discharge losses. The ratio of stored to extracted energy (overall efficiency/efficiency) in these systems is between 30 and 95 percent. In the case of virtual "Bitcoin mining energy storage systems", the overall efficiency rises and falls with the price of Bitcoin and electricity.

Other advantages of virtual Bitcoin energy storage systems compared to physical battery storage systems include lower maintenance, installation and disposal costs, shorter amortization times, greater scalability and faster response times. In addition, there are no capital costs for the energy. The portability of the stored energy is also associated with no costs.

Conclusion

The independent study presented presents cryptocurrency mining facilities as a last resort for local power grid operators to store excess energy. The surplus energy is considered to be the energy source for the mining devices that generate cryptocurrencies, which are considered to be the basis for buying energy that is needed when there are energy shortages in the grid.

Using data from a case study in Finland, the authors of the study show that the use of mining equipment as virtual energy storage can significantly reduce operating costs and the amount of unused surplus energy. It also reduces greenhouse gas emissions and increases the reliability of the electricity grid. It is an innovative, flexible and adaptable solution for long-term energy storage and optimized use of renewable energy that can play an important role in the transition to sustainable and economically viable energy systems.

Although the study offers calculation models, the easy transferability of the results to other electricity grids in other countries and under other conditions is not guaranteed. The high energy requirements, regulatory challenges and market risks must be carefully weighed up. A detailed and specific analysis of the respective local circumstances and framework conditions is necessary to assess the feasibility and efficiency of this approach. Ultimately, this study provides a basis for further scientific examination of this topic and comparisons with other innovative and long-term energy storage methods such as hydrogen.

As long as the storage of energy in conventional energy storage systems is too costly and no better alternatives appear on the market, Bitcoin mining remains a promising solution for all electricity grid operators as the last resort for energy utilization.