In recent months, the regulatory winds in the US have shifted towards a more crypto-friendly approach. Now there are further developments in this regard and concerns are spreading in the Bitcoin community that some plans could worsen the environment for Bitcoin. What exactly is happening in the USA at the moment?

H.J. Resolution 109

H.J. Resolution 109 has caused quite a stir. This was intended to repeal the Securities and Exchange Commission's SAB 121 regulation, which obliges banks to hold equity in the amount of the crypto assets held in custody. The resolution would therefore have effectively ensured that traditional banks could increasingly enter the Bitcoin and crypto market as service providers.

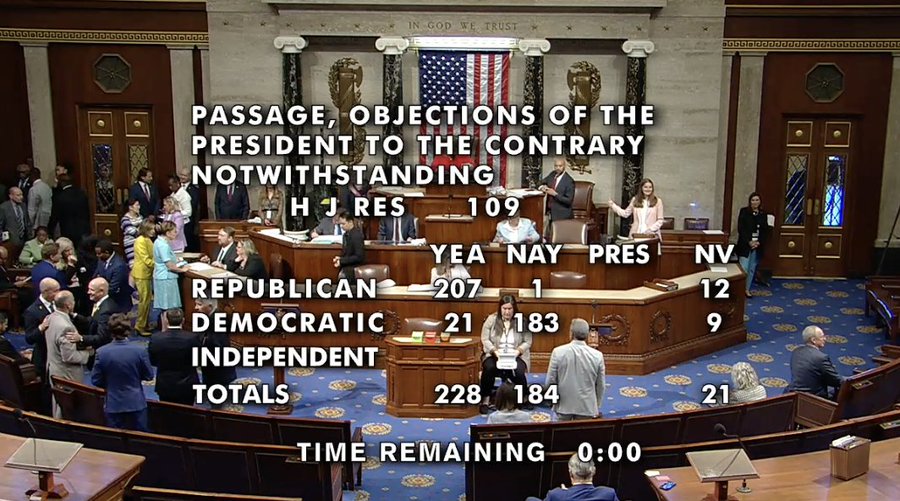

The House of Representatives and the Senate voted in favor of H.J. Resolution 109, but President Joe Biden used his previously announced veto. His reasoning was that reversing the SEC staff's "considered" judgment risked "undermining the SEC's broader authority over accounting practices" and that the measure would "jeopardize the welfare of consumers and investors."

With a two-thirds majority in the House of Representatives and the Senate, it would have been possible to overrule Biden and make the resolution legally binding despite the veto. Yesterday, however, this plan failed. In the House of Representatives, as in the first round, 228 MPs voted in favor, but 290 votes would have been needed.

Although the resolution failed, it is remarkable how much support it received in politics. Even some of the Democrats, who tend to be hostile to Bitcoin, backed it and even the banking lobby urged Biden not to veto it.

Making it easier for established financial institutions to offer crypto custody services is also desirable from a pro-Bitcoin perspective. Bitcoin allows you to be your own bank, but there will always be people who prefer to have their coins stored by reputable institutions. And it is an advantage if not only a few companies can offer this service, but also the many banks in the USA.

In fact, the SEC itself has now given in and relaxed SAB 121 a little. According to a report by Bloomberg Tax, the supervisory authority has opened up possibilities so that banks may no longer have to report their customers' crypto holdings on their own balance sheets. According to Bloomberg's source, several large banks that have been in close contact with SEC staff since last year are allowed to bypass the accounting rule if they ensure that clients' crypto assets are protected in the event of a bank failure.

FIT21

With FIT21, there is yet another pro-crypto push in US politics. This involves transferring some of the regulatory responsibilities for the crypto market from the SEC to the Commodity Futures Trading Commission (CFTC). The House of Representatives has already voted overwhelmingly in favor of this bill - Blocktrainer.de reported. The vote in the Senate is still pending; if it passes there, Joe Biden would still have to sign - the President has not yet announced a veto.

The SEC is generally considered to be anti-crypto, which is why support for FIT21 is rather high in the crypto community. The bill provides for the CFTC to regulate cryptocurrencies that are classified as "commodities". The regulatory authority has had a more liberal approach to this classification for a long time. For example, the CFTC has been certain for years that the second-largest cryptocurrency, Ethereum, is a commodity alongside Bitcoin, while SEC Chairman Gary Gensler apparently took a diametrically different view.

To date, the CFTC has regulated the futures market for commodities - including Bitcoin and Ethereum. However, it still intervenes when fraud involving Bitcoin and Co. takes place. If the CFTC has its way, it would also like to monitor the spot market for "commodity cryptocurrencies", where there is still no state supervision. This emerged from a Senate Agriculture Committee hearing on oversight of digital commodities on Wednesday this week.

What concerned me the most during this expansion of this digital asset class is that while everyday americans fall victim to one digital asset scam after another, there remains no completed legislative response. [...] I believe the single most important thing i've done and continued to do is to advocate to this body to fill the regulatory gap. [...] This gap for non-security-tokens continues to constitute a majority of the digital asset market measured by market capitalization. As the digital asset market continues to integrate into traditional financial institutions, concerns regarding broader market resiliency and perhaps even financial stability will ripen. In short: our current trajectory is not sustainable.

CFTC Chairman Rostin Behnam at the hearing

Among other things, the CFTC would like to see crypto exchanges having to register directly with it. It also became clear at the hearing that the CFTC complains that almost half of its resources are used for the crypto market, but that it is not allowed to regulate it itself and can only intervene if there are already injured parties.

If the CFTC were to monitor the commodities part of the crypto market, which according to the current definition accounts for around 70 to 80 percent of total market capitalization, it would need additional resources, according to its own statements. The authority has always emphasized that its aim is not to overregulate the market, but to allow innovation. However, there is growing concern in the Bitcoin community that supervision by the CFTC would lead to major problems and disadvantageous regulation.

Long story short, this committee is pushing to give the CFTC regulatory oversight over spot bitcoin markets, which is an unprecedented expansion of CFTC authority into retail commodities trades whereas in the past they have exclusively had jurisdiction over only commodities derivatives markets. If the CFTC is granted this expansion of authority it would mean that they are likely going to require any bitcoin company to register with the federal government and have enhanced KYC/AML requirements. To be clear, this won't only affect exchanges, but any company that touches spot bitcoin. These efforts are being spearheaded on the crypto side via lobbying efforts by Kraken, Coinbase and Ripple. Not shocking because this would likely enable them to trivially erect regulatory moats. It looks like the bi-partisan effort will be looking to pass something through the House and into law rather quickly. Likely before the election. [...]We need less regulation, not more.

Marty Bent, founder of a Bitcoin media company on 𝕏

At the hearing, CFTC chief Ronstin Behnam was also not averse to demanding data on the energy consumption of cryptocurrencies, as is also being initiated in the European Union as part of MiCAR.

Crypto industry exploits the current situation

Donald Trump is currently focusing on Bitcoin in his election campaign and the 78-year-old can apparently differentiate between the most relevant crypto asset and the thousands of other cryptocurrencies. While the likely next US president is being advised by David Bailey of the pro-Bitcoin Bitcoin Magazine and will even appear at the largest Bitcoin conference organized by them, the Democrats are also approaching the topic - albeit somewhat bumpily.

Anita Dunn, senior advisor to President Joe Biden, took part in a roundtable discussion with high-ranking figures from the crypto industry on Wednesday. This "roundtable", which was supposed to be about keeping the innovation of Bitcoin and blockchain in the US, looks more like lobbying by the crypto industry in hindsight.

This is evident from the list of participants. For example, Brad Garlinghouse, the CEO of Ripple Labs, the company behind the cryptocurrency XRP, was present. Ripple Labs has already teamed up with Greenpeace USA in the past to denigrate Bitcoin due to its energy consumption. Also in attendance was Mike Novogratz, CEO of crypto investment firm Galaxy Digital. Novogratz drew attention to himself in 2022 when he got a tattoo of the cryptocurrency Luna, not long before it collapsed.

In general, the SEC was a thorn in the side of many crypto companies, as it wanted to classify their cryptocurrencies as unregistered securities. This would have entailed penalties, as the issuance of securities normally entails certain reporting obligations. The crypto exchanges also spoke out against the classification of some cryptocurrencies as securities, which is probably because they would have had to stop the lucrative trading of a large number of coins at the very least.

At the aforementioned meeting behind closed doors, representatives of the crypto industry are said to have attacked Anita Dunn for the Democrats' handling of cryptocurrencies. "You guys suck at crypto," one participant reportedly said to Dunn in an exchange described by FOX Business as "respectful but blunt."

Is the regulatory situation deteriorating?

The regulatory treatment of Bitcoin in the USA is currently quite favorable. In contrast to Europe, Bitcoin spot ETFs have been available to buy there since January of this year and companies are now also allowed to report their Bitcoin at fair value on their balance sheets.

What is still missing and could certainly unlock further potential for the asset would be if SAB 121 is finally overturned, making it easier for banks to store Bitcoin for their customers and thus penetrate the market. If Donald Trump becomes president, there is a good chance that SAB 121 will soon be a thing of the past.

In addition, futures based on Bitcoin spot ETFs cannot yet be traded and Bitcoin cannot be converted directly into spot ETF shares. Michael Saylor, founder of the Bitcoin-based stock corporation MicroStrategy, speaks of a "minimalist acceptance" of Bitcoin in this context.

The pressure on politicians and regulatory authorities has apparently increased so much in recent weeks and months that a strong change of direction is likely to result in overshooting the mark. For example, the obviously non-decentralized cryptocurrency Ethereum is also classified as a commodity and the SEC has approved ETH spot ETFs, making it more difficult for the general public to recognize the fundamental difference to Bitcoin.

Furthermore, with the sudden pro-crypto turn in general US policy, crypto companies, which often work against Bitcoin, seem to be exerting influence. It remains to be seen whether the CFTC's potentially imminent supervision of the spot Bitcoin market will really lead to major problems in terms of stricter regulation and far-reaching registration obligations. On the one hand, FIT21 has not yet been passed and, on the other, Trump's team and the Republicans explicitly plan to protect the privacy of digital assets according to their draft party platform.

It is important to continue to monitor the situation and draw attention to the fact that supposedly "pro-Bitcoin laws" and a hasty change of direction in regulation could also put obstacles in the way of Bitcoin adoption.