Bitcoin spot ETFs are currently soaking up capital like crazy again - almost three billion US dollars have flowed into the US investment products over the past twelve trading days. Yesterday was the best trading day for the ETFs in almost seven weeks.

Could this be in anticipation of the Bitcoin conference taking place in Nashville from Thursday to Saturday? Rumors are currently spreading that presidential candidate Donald Trump could announce the plan for Bitcoin as a reserve asset of the USA during his speech there. There are also indications that Tesla CEO and Trump supporter Elon Musk will be in attendance.

Demand for Bitcoin ETFs picks up speed

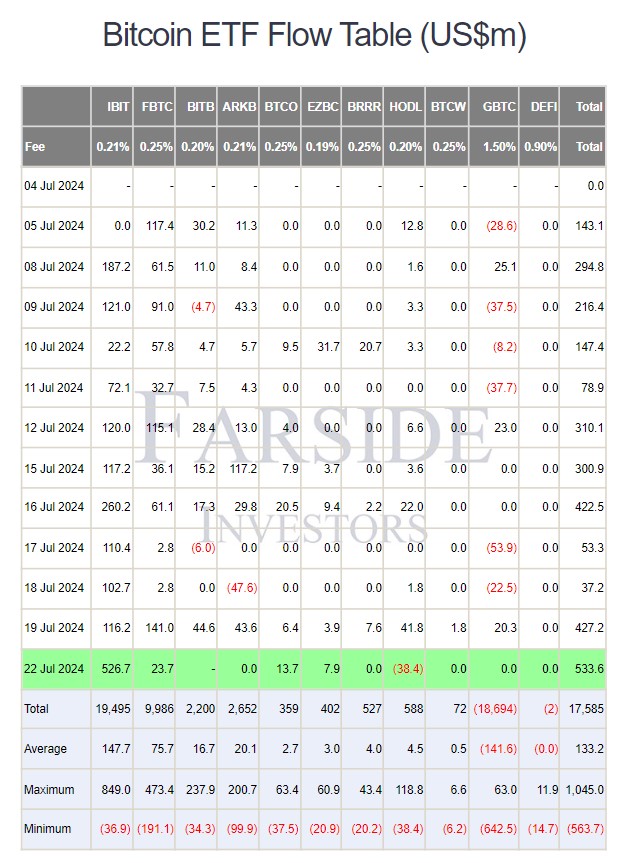

For twelve trading days in a row, US Bitcoin spot ETFs have once again recorded net inflows. Although the record for investment products approved in January is 19, this is already a respectable streak. During this period, the ETFs have soaked up 2,965.4 million US dollars, an average of around 250 million US dollars per trading day.

IBIT, the Bitcoin ETF from BlackRock and by far the largest exchange-traded Bitcoin fund, was the clear leader over the past trading days.

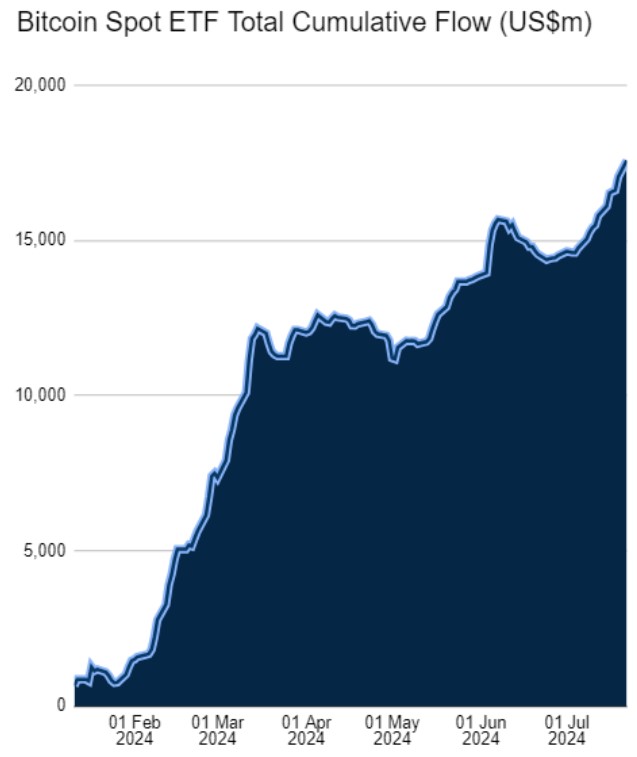

The cumulative inflows, i.e. the total daily net inflows, are currently at a new all-time high. More than USD 17.5 billion in net new capital flowed into the investment products. That is almost as much as the market capitalization of Commerzbank.

In total, there are now over 914,000 Bitcoin worth more than USD 60 billion in the US spot ETFs. If things continue at this pace, the investment products are likely to break the one million BTC mark within the next few weeks.

As of yesterday, the Bitcoin ETF from BlackRock, the world's largest asset manager, was already the fourth best performing exchange-traded fund in terms of inflows since the start of the year - and this does not even take into account the USD 526.7 million that IBIT alone soaked up yesterday.

BlackRock's Bitcoin ETF is even outperforming heavyweights such as Invesco's large ETF on the Nasdaq 100 technology index. The ETF with the ticker QQQ has around USD 300 billion in assets under management, roughly five times as much as all Bitcoin spot ETFs combined, but so far this year has been able to absorb less fresh capital than the largest Bitcoin ETF.

IBIT has passed QQQ into YTD net flows. And could pass Vanguard's Total Stock Market ETF very soon too. Compare the net sizes of these ETF's vs. net inflows. Demand for Bitcoin via ETF has been relentless. Unprecedented really. pic.twitter.com/CyD3p7c9CX-

Spencer Hakimian (@SpencerHakimian) July 22, 2024

Speculation on big news at the weekend

One reason for the significant pick-up in inflows into Bitcoin spot ETFs could be the Bitcoin-friendly developments in US politics. Interestingly, the publication date of the Forbes article, which addressed the question of whether the US could rely on Bitcoin as a reserve asset under Donald Trump, marks the last day of net outflows from the ETFs so far.

And since rumors spread last Thursday night that the presidential candidate was touting the plan for a US strategic Bitcoin reserve at this week's Bitcoin conference, ETFs soaked up around $500 million each on Friday and Monday. It could therefore be the case that Wall Street wants to stock up on the asset before Trump's speech - the ETFs are not tradable on Saturdays.

This euphoria is also being fueled by the CEO of BTC Inc, the company behind the largest Bitcoin conference. David Bailey shares bullish posts on the platform 𝕏, such as that there will be a new all-time high for Bitcoin on Saturday, the day of the highly anticipated Trump speech.

There are also indications that Elon Musk will also be present at the conference. Musk is a major supporter of Trump - including financially - and a Bitcoin advocate. With his company Tesla, the currently richest person in the world holds almost 800 million US dollars in Bitcoin. Musk's private jet is said to have recently landed in Tennessee, the US state where the conference in question will take place from Thursday. The billionaire also posted a profile picture on 𝕏 with laser eyes on Sunday. Laser eyes are a distinguishing feature for so-called "Bitcoin maximalists".

Since Musk's announcement in February 2021 that Tesla had bought Bitcoin and that the car manufacturer would accept the digital currency as a means of payment triggered a great deal of Bitcoin hype, the latest indications have led to bullish speculation. It is conceivable that the Tesla CEO could announce that his company is selling cars for Bitcoin again. Tesla had discontinued this in 2021 due to environmental concerns, but for some time now the sustainable energy mix of Bitcoin mining has clearly been above 50 percent, which Musk cited as a prerequisite for reintroducing BTC as a payment method.

Exciting week ahead

Tesla is publishing its figures for the second quarter this evening. As part of the report and the earnings call, there may already be news about Bitcoin - for example, that the car manufacturer has bought more Bitcoin. It remains to be seen whether Elon Musk will actually attend the Bitcoin conference. Unlike Donald Trump, Musk has not been announced by the organizers.

However, Donald Trump's speech on Saturday at 9 pm German time is likely to be particularly exciting. The potential Bitcoin reserve under Trump's presidency has now also become a topic in leading media such as Forbes and even CNBC.

Now @CNBC is already discussing whether #Bitcoin will become the reserve currency of the US under @realDonaldTrump könnte🇺🇸👀

Blocktrainer (@blocktrainer) July 22, 2024

"It's possible."

One proposal is to transfer the confiscated 213.000 #BTC to the Treasury - unlike what was done in 🇩🇪😬 pic.twitter.com/PLLADysvho-

It is therefore only natural that investors are already stocking up on the asset in anticipation, which is only a good 10% away from reaching a new all-time high.

However, due to the apparently high expectations, there is of course also immense potential for disappointment - for example, if Elon Musk does not show up and Donald Trump's speech does not contain any major announcements.

Blocktrainer.de will report on further developments - even first-hand from the Bitcoin conference in Nashville, Tennessee.