Bitcoin scratches all-time high - comeback in ETF inflows

After a short dry spell in April, inflows into Bitcoin spot ETFs have picked up significantly in recent weeks. In just three weeks, more than three billion US dollars have flowed into the investment products - 868 million US dollars of which on yesterday's trading day alone.

Meanwhile, the Bitcoin price is trading at around USD 71,000 again, close to the all-time high of around USD 73,800 set in mid-March.

Comeback in inflows into Bitcoin spot ETFs

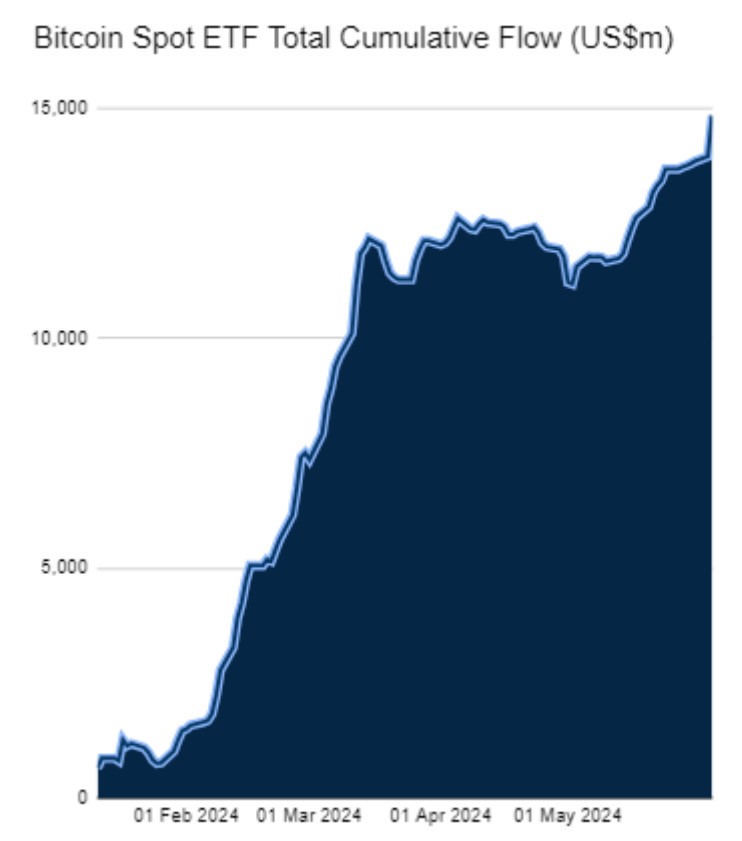

Following ETF approval in January of this year, Bitcoin spot ETFs went on an incredible run of inflows. From the beginning of February to mid-March, the investment products soaked up more than USD 10 billion in capital, exceeding even the most bullish expectations. Since then, not only has the Bitcoin price stagnated, but also the inflows into the ETFs. At times, these were even negative again. However, the correction mode has been over since May 1. The Bitcoin price is picking up speed again, hand in hand with demand for ETFs. The cumulative net inflows into ETFs are currently at an all-time high of just under USD 15 billion.

Since May 13, there have only been trading days in which the investment products collectively absorbed capital. This means that there is currently an active inflow series of 16 trading days in which more than three billion US dollars of fresh capital has flowed into Bitcoin. The previous record for Bitcoin ETFs is 17 consecutive trading days.

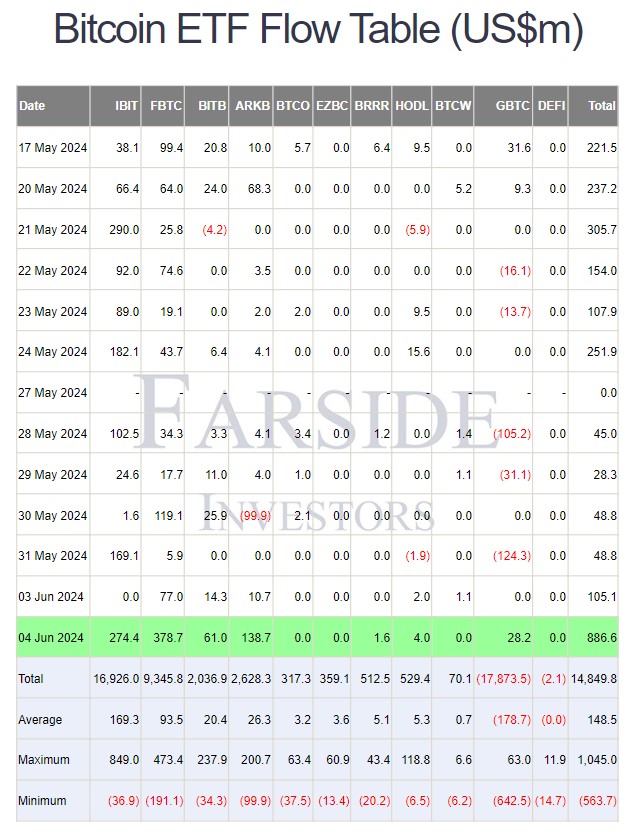

Yesterday's inflow of 886 million US dollars was also almost a record. Only on March 12 did the investment products together absorb more capital, namely USD 1,045 million. IBIT, the Bitcoin ETF from BlackRock, recorded inflows of around USD 275 million yesterday alone. However, FBTC from Fidelity, the world's third-largest asset manager behind BlackRock and Vanguard, stood out with almost USD 380 million on yesterday's trading day.

Even Grayscale's GBTC, the Bitcoin ETF that was allowed to be converted from a closed-end trust into a spot ETF and has since been the primary source of selling pressure, saw decent inflows of just under USD 30 million yesterday. Last week, Blackrock's IBIT overtook GBTC to become the largest Bitcoin spot ETF - Blocktrainer.de reported.

The renewed surge in interest in the investment products, which are now almost five months old, surprised some market observers. Others, however, made fun of the fact that the 𝕏 platform increasingly claimed that everyone who wanted to buy had already bought. This does not appear to be the case.

Nate Geraci, a renowned ETF analyst, picked up on this with an ironic tweet.

Nearly $900mil into spot bitcoin ETFs today...

I

That's right. Close to $1bil inflows in a single day.

Five months after launch.was told several months ago that all of the "degen retail" investors who wanted to buy had already done so & there was nobody left.

- Nate Geraci (@NateGeraci) June 5, 2024

How can this be?

As shown by the submissions of the asset managers subject to reporting requirements, institutional interest in the spot ETFs was particularly high - Blocktrainer.de reported. In addition to some hedge funds, the first US pension fund also built up a Bitcoin position via the new investment products. Meanwhile, retail investors appear to have barely returned to the market.

It remains to be seen whether the current series of inflows into Bitcoin ETFs will continue and which major financial service providers will report having built up Bitcoin positions via ETFs in the second quarter. However, if demand for exchange-traded Bitcoin funds remains at this high level, nothing should stand in the way of a new all-time high in the Bitcoin price.