After Bitcoin briefly reached the USD 70,000 mark on Monday, the asset slumped by almost 14% at times over the course of the week. On Friday alone, the Bitcoin price fell by six percent.

Despite a positive news situation, the Bitcoin price has remained in a range between USD 53,500 and USD 74,000 since the end of February - with strong ups and downs.

What are the factors that have put Bitcoin under pressure in recent days and what could happen next?

Fear of recession

Recession fears have been spreading in the USA for a few days now. The labor market data reported yesterday from the United States turned out to be significantly worse than the market had expected. For example, the unemployment rate of 4.3 percent was 20 basis points higher than the expected 4.1 percent.

In addition, the major stock corporations have largely disappointed during the reporting season - particularly with regard to the outlook for the coming months.

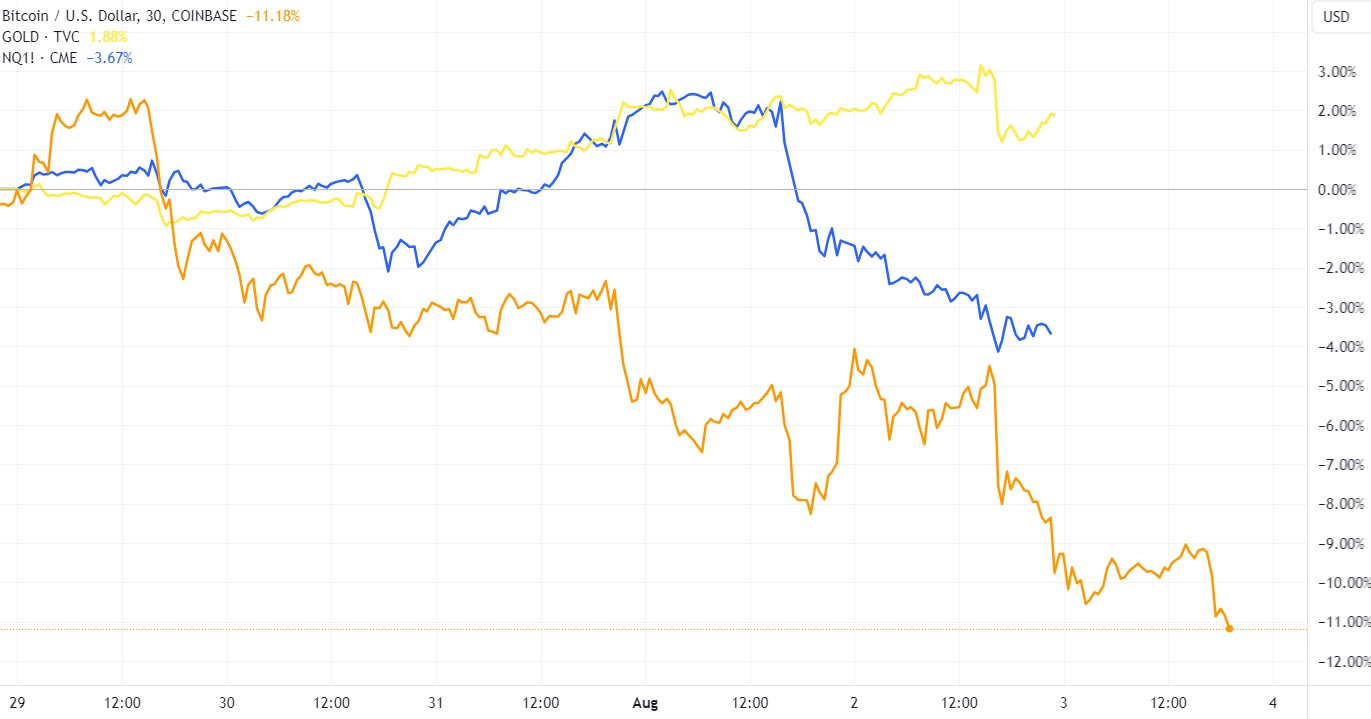

As a result, the stock market, which had previously been running hot, is currently under pressure. The Nasdaq 100 technology index lost several percent over the course of the week and was trading almost eleven percent below its mid-July high at the close of trading on Friday.

Bitcoin seems unable to decouple itself from the sell-off on the traditional markets and - unlike the crisis metal gold - is unable to buck the downward trend on the stock markets. In this correction, market participants are probably not treating the asset as the "safe haven" that many Bitcoin enthusiasts see it as.

First interest rate cut by the US Federal Reserve not until September

Wednesday of this week also saw the US Federal Reserve's decision on key interest rates. As the market had assumed, the Fed kept interest rates in the range of 5.25% to 5.50%. Nevertheless, there are currently concerns that the Federal Reserve (Fed) will cut interest rates too late and thus drive the already weakening economy against the wall.

The next central bank meeting is not until September 18. As the Fed is supposed to ensure full employment in addition to its mandate of price stability, the first interest rate cut in September is virtually a foregone conclusion, at the latest after the weak labor market data. The market is even assuming a probability of over 20 percent that there will be two interest rate cuts in September - to a range of 4.75 to 5.00 percent. And at least three interest rate cuts are currently priced in by the end of the year.

Geopolitical uncertainties

The situation is also coming to a head on the geopolitical front at the moment. Iran is threatening Israel with a retaliatory strike following the killing of the leader of Hamas in Tehran. Meanwhile, the USA, Israel's closest ally, is sending warships and fighter jets to the Middle East.

An escalation in the Middle East involving the USA would have far-reaching consequences for the entire world and therefore also for the economy and capital markets. The market currently seems to be pricing in the risk of a much larger conflict breaking out.

Factors from the Bitcoin market

In addition to macroeconomic headwinds, there are also factors specifically from the Bitcoin market that are currently putting pressure on the price.

Selling pressure via ETFs

Although the Bitcoin spot ETFs from the US were predominantly on the buy side despite ups and downs in the Bitcoin price in recent weeks, they recorded strong outflows of almost USD 250 million on Friday. This was the worst trading day for the investment products since May 1, 2024, and the fourth worst ever since their launch in January.

Bitcoin-internal selling pressure

Bitcoin redemptions by the Bitcoin exchange Mt.Gox, which collapsed more than ten years ago, are currently still in full swing. Although, surprisingly, the former customers apparently did not want to sell for the time being, a total of more than 140,000 BTC have been transferred to entities that can sell them at any time. There are still more than 30,000 BTC on the Mt.Gox wallet, which will gradually end up with other aggrieved parties in the coming weeks.

According to the analysis platform Arkham Intelligence, the bankrupt crypto company Genesis has also moved around 16,600 Bitcoin with an equivalent value of more than one billion US dollars. According to Arkham, these are probably also linked to repayments.

Liquidation cascades

The usual liquidation cascades in Bitcoin are likely to have created additional selling pressure as part of the correction. Those who place leveraged bets on rising prices are forced to sell their position if the price falls to a certain level. This will cause the price to fall all the more quickly and sharply.

Light at the end of the tunnel

The factors that currently appear to be causing the price of Bitcoin to fall are likely to be relatively short-lived. The time will come when the repayments of Genesis and Mt.Gox have been completed. Political developments do not usually have a long-term impact on the capital markets either.

Of course, it cannot be ruled out that a major financial crisis or even a major war will break out, which could mean another strong headwind for Bitcoin in the short term, but fundamentally nothing has changed for the asset. The Bitcoin hashrate is currently even at a new all-time high, which speaks for a strong financial position and confidence among mining companies.

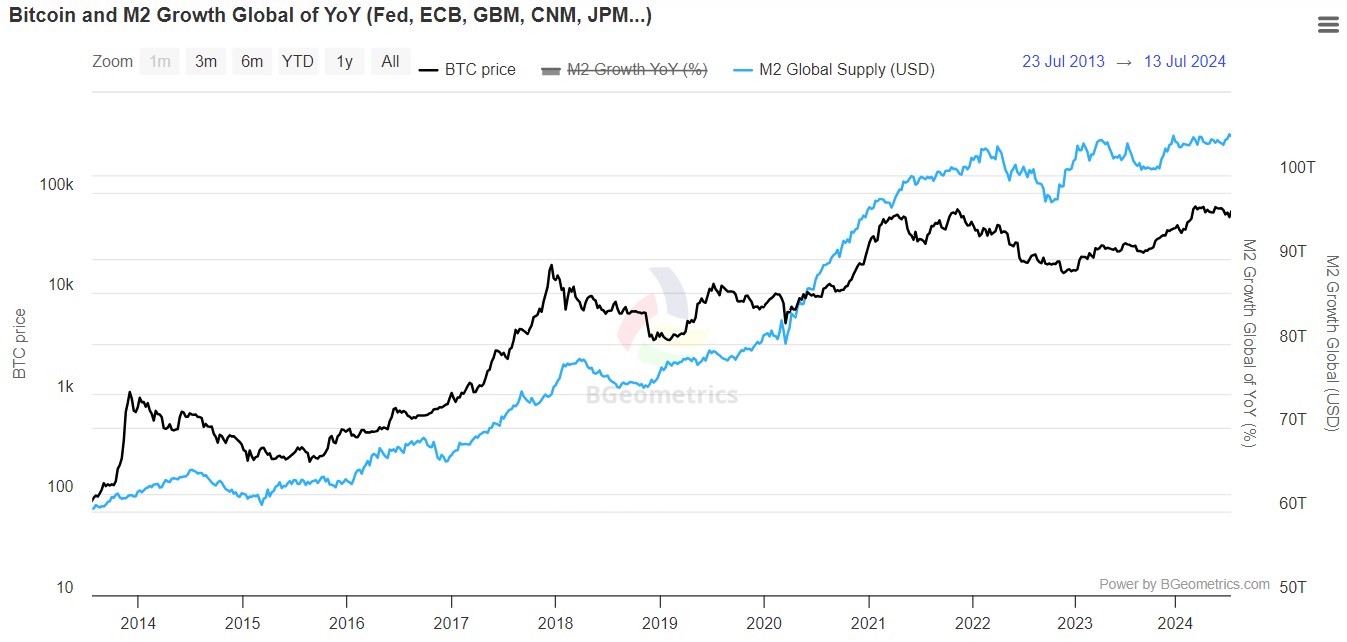

Even if a crisis breaks out, this will inevitably lead to further money printing by central banks. This is only likely to push asset prices even higher in the medium and long term.

The "global money supply", with which the Bitcoin price correlates strongly, is currently already at a new all-time high. In the foreseeable future, the world's most relevant central bank, the Federal Reserve, will also loosen its monetary policy again, which should only further increase the amount of money in circulation worldwide. This trend, which is probably the number one price driver for Bitcoin, is unstoppable and is probably still in its infancy due to the ever-increasing global debt.

At the moment, the news surrounding Bitcoin even gives reason for strong optimism. Not only is presidential candidate Donald Trump considering using Bitcoin to solve the US national debt problem, but demand from institutions is also likely to increase further.

Billion-dollar listed companies such as MicroStrategy and Block Inc. are regularly buying Bitcoin and the ball even seems to have started rolling with US state pension funds. One after the other is currently pouncing on the Bitcoin spot ETFs.

According to a report by CNBC, the major bank Morgan Stanley will also soon allow around 15,000 financial advisors to actively promote Bitcoin spot ETFs. Previously, major banks only sold investment products to customers if they explicitly asked for them, explains CNBC.

The sharp price drops typical of Bitcoin should not cause uncertainty - especially if the long-term vision behind Satoshi Nakamoto's creation is convincing.