Bitcoin price weakens despite positive news

After Bitcoin set a new all-time high of around USD 73,800 on March 14 of this year, the air seems to have run out. Despite a large number of positive reports and record highs on the stock markets, Bitcoin has been in a sideways phase for several weeks.

In the past 16 days alone, the Bitcoin price has slumped by more than 10%. One BTC currently costs around 64,000 US dollars, which means that a price increase of around 15 percent separates the asset from new highs.

Stock markets in party mood while Bitcoin falls

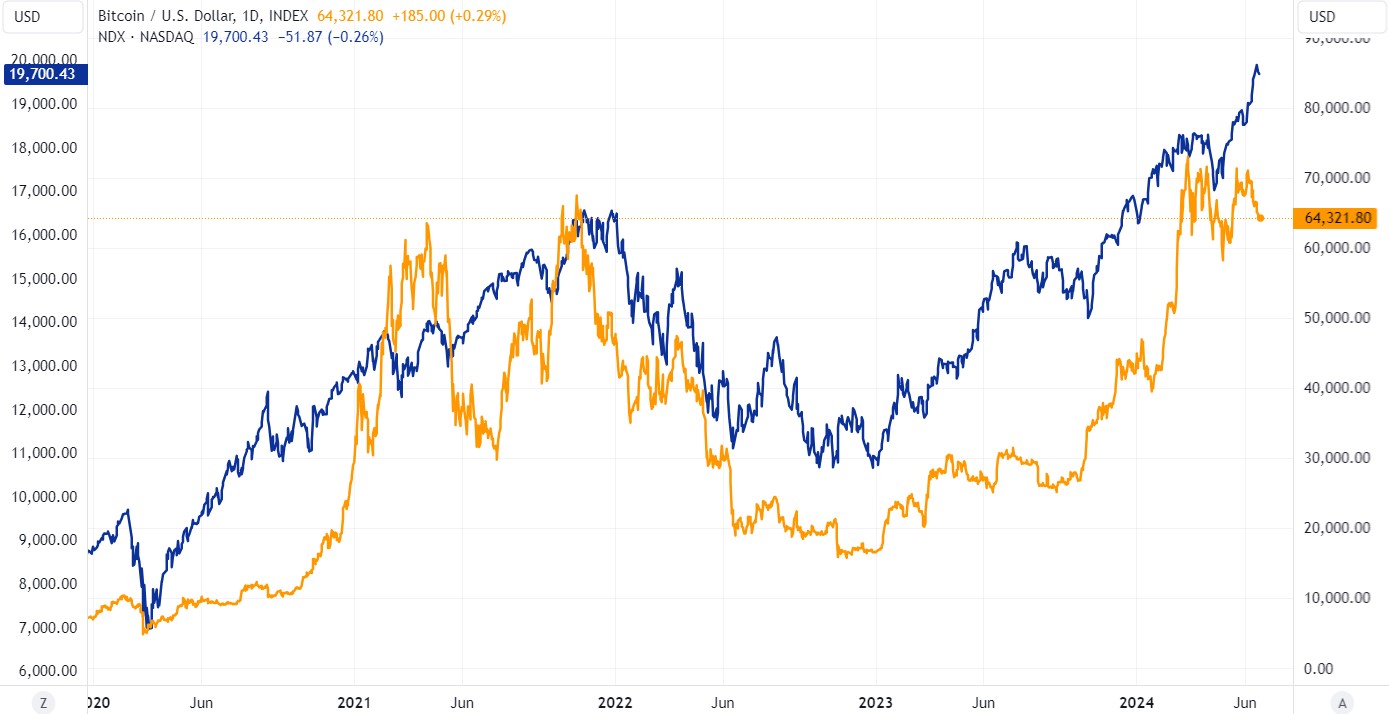

Normally, assets generally exhibit a strong correlation with one another, which is probably primarily related to US monetary policy and liquidity. In the minds of many investors, Bitcoin is probably still a risk-on asset that they buy in phases when money is generally looser. Accordingly, a strong correlation has been observed in the past, particularly with technology stocks and the Nasdaq 100 technology index.

Bitcoin and the Nasdaq 100 have benefited particularly strongly in response to the loose monetary policy during the coronavirus pandemic. As the interest rate turnaround loomed, Bitcoin entered a downtrend a few weeks before the Nasdaq 100. Both asset classes bottomed out at the end of 2022 and have since risen sharply again. The high correlation over the past few years is clearly visible, even though Bitcoin has performed much better since the coronavirus crash. Bitcoin has so far recorded a price increase of over 1,500% since the coronavirus low, while the Nasdaq 100 has risen by less than 200%.

It is unusual that Bitcoin has fallen significantly since the beginning of June, while the US stock market continues to rise to new highs. Some market observers assume that Bitcoin will soon close this gap again. However, it is also conceivable that Bitcoin will initiate a change of direction - as it did towards the end of 2021 - before the stock market, which is currently running hot.

If the stock markets also go into correction mode now, this could well lead to Bitcoin continuing to struggle.

Bitcoin falls despite bullish news

There are currently no fundamental reasons for this relative weakness - on the contrary. There has been some news in recent weeks that would have justified a significant rise in the price:

The first pension fund from the USA has invested around 160 million US dollars in Bitcoin via the new ETFs, possibly setting the ball rolling. In addition, the US election campaign is currently revolving around Bitcoin. Donald Trump is focusing on winning over the Bitcoin community and even President Joe Biden seems to want to follow suit in this regard.

Meanwhile, more and more companies are adopting a Bitcoin strategy. The first mover MicroStrategy recently bought almost 800 million US dollars worth of Bitcoin and the major payment service provider Block has been using a Bitcoin savings plan since April.

Positive news should normally be reflected in a rising Bitcoin price. Ultimately, however, the price of an asset is determined by buying and selling demand. And if the sales volume currently outweighs the demand, i.e. buyers and sellers are currently meeting at a price of around USD 64,000, then the market is probably finding that Bitcoin is fairly valued at this price.

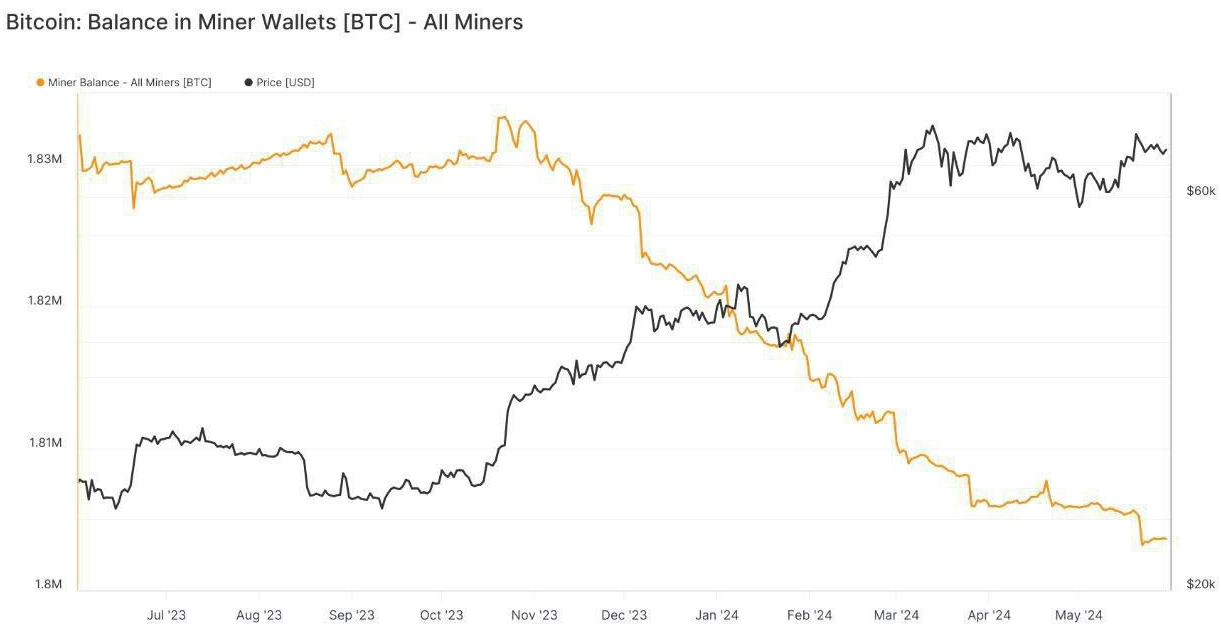

Miner capitulation

Bitcoin miners currently appear to be triggering selling pressure. Since the end of last year, miners have been significantly reducing their Bitcoin holdings. Although this has not prevented the Bitcoin price from rising in recent months, a recurring seller can be seen here.

This "miner capitulation" could possibly continue. According to Glassnode, the mining companies together still hold more than 1.8 million BTC worth around 116 billion US dollars. And as miners have only been able to pay out 3.125 instead of 6.25 BTC per new block - plus transaction fees - since the Bitcoin halving in April, profitability is currently suffering. The Bitcoin price has not risen significantly since then, nor have transaction fees gone through the roof in the long term. The fact that mining companies are finding it more difficult at the moment can also be seen from the slight decline in the hashrate. Companies could continue to compensate for their suffering profitability by selling off their ample Bitcoin holdings.

Weak ETF data

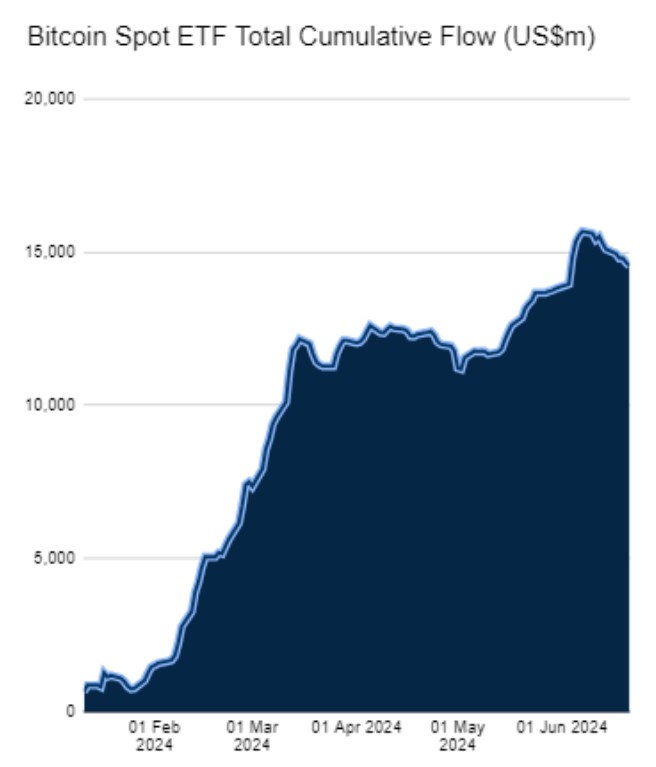

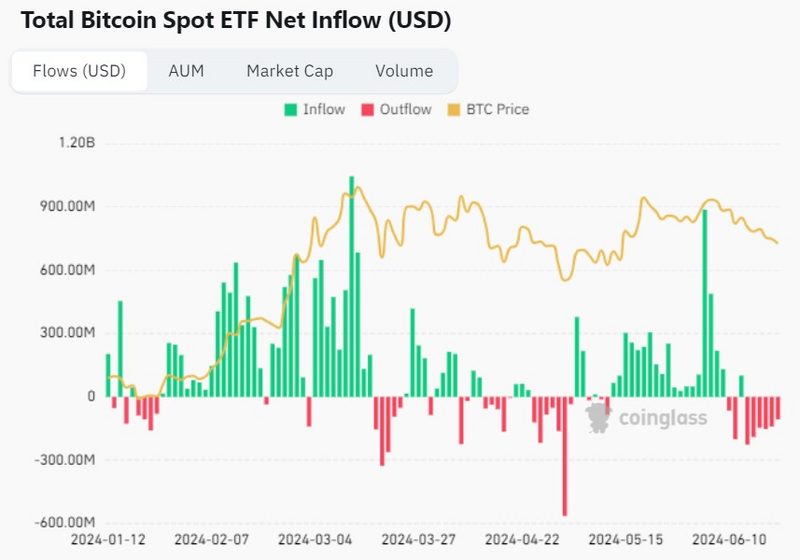

Bitcoin ETFs from the US are also causing selling pressure. After the investment products only ended their new record inflow series of 19 days on June 10, more than one billion US dollars have flowed out of the ETFs again since then. Cumulative inflows fell from over USD 15.6 billion to less than USD 14.6 billion during this period.

In the past nine trading days, there was only one day with green figures across all ETFs - namely June 12, the day on which lower-than-expected inflation data from the USA triggered a small price firework on the capital markets.

At the moment, funds have flowed out of the investment products for six days in a row. The previous negative record for Bitcoin spot ETFs in this respect is seven days. This was the case around the local low of the Bitcoin price on May 1.

The correlation between ETF inflows and the price of bitcoin remains high, suggesting that bitcoin trading on Wall Street is currently the strongest influence on where the asset is heading. This is also made clear by the fact that there is hardly any impetus for the Bitcoin price at weekends or on US public holidays.

Just a breather?

Despite the current correction, Bitcoin is still up more than 50 percent since the start of the year, while the Nasdaq 100 has gained less than 20 percent in the same period. As the Bitcoin price literally went through the roof in the first quarter due to the ETF hype, the short breather is probably not inappropriate - not least because Bitcoin has already risen by 150% in 2023.

Bitcoin had probably already anticipated a little of the coming cycle, which was also made clear by the fact that the asset managed to break the all-time high of the previous cycle for the first time before the halving. However, Bitcoin has remained at the all-time high of the previous cycle for longer than most would have expected. In 2020, Bitcoin managed to break through this magical mark in a much shorter period of time and rise to significantly higher new highs. Nevertheless, the consolidation at this level in early 2017 also lasted several weeks.

It remains to be seen how it will play out this year. The current news situation is likely to be quite suitable for the continuation of the bull market. A few days ago, Bernstein, one of the most relevant analyst firms on Wall Street, raised its price target for Bitcoin for the coming year to USD 200,000. Bernstein even considers a Bitcoin price of one million US dollars by 2033 to be likely. This report was picked up by some major media houses such as Forbes.

Interest rate cuts and a loose monetary policy by the US Federal Reserve are also on the cards for this year. The market currently assumes a probability of over 60% that the Federal Reserve will cut the key interest rate for the first time in September. A more expansive monetary policy environment could further fuel the general willingness to invest and give Bitcoin a tailwind, as it did in 2020 and 2021.

In addition, the US presidential election campaign should continue to focus media attention on Bitcoin, which should bring the asset back into the mainstream of society.